Initial Registration

Smt BL Hemavathi Memorial Trust has

been

registered under section 12(A) and granted

recognition under section 80(G) of the Income

Tax Act 1961, by Income Tax department, Government

of India. The recognition order under section

80(G) was

Trust/718/10G/205/00-01/CIT-II dated 14th

Dec 2000, valid from 11.12.2000 to 31.03.2002 and

was issued by the Commissioner of Income Tax, KTK-II,

Bangalore, Karnataka, India

Renewals(2002-05)

Renewal of recognition under section

80(G) of the Income Tax Act 1961 was granted for the

period 01.4.2002 to 31.03. 2005 vide letter No

DIT(E)/80G/

Vol 1/472/W-1/2002-03 dated 14th Feb 2003 by the

Director of Income Tax (Exemption), Bangalore,

Karnataka, India.

Renewals(2005-08)

Renewal of recognition under Section

80(G) (5) (VI) of the Income Tax Act 1961 was

granted for the period 01.4.2005 to 31.03. 2008

vide letter No

DIT(E)/80G/191/W-2/05-06 dated 31st

Aug 2005 by the IT Officer (Exemption) Ward-2, for &

on behalf of the Director of Income Tax (Exemption),

Bangalore, Karnataka, India.

Renewals(2008-11)

Renewal of recognition under Section 80(G) (5) (VI)

of the Income Tax Act 1961 was granted for the

period 01.4.2008 to 31.03.2011 vide letter No

DIT(E)/BLR/80G/AAATB6088K

/ITO(E)-3 Vol2008-09 dated 22 Sep 2008 by Income

Tax Officer (Exemption-3), for & on behalf of the

Director of Income Tax (Exemption), Bangalore,

Karnataka, India.

Subsequent Renewals have not been necessiated due to

change in policies of Income Tax Exemption Act. As

per the new policy changes, Income Tax Exemption

under Sec 80G, once obtained remains for the

lifetime of the Trust.

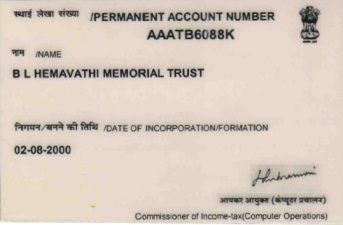

PAN

Permanent Account Number (PAN) of

our TRUST is

AAATB6088K